7 Tips to Start a Homestead According to Reddit

Homesteading refers to a lifestyle or practice of self-sufficiency where individuals or families create … Read more

How to Build a DIY Pollinators Hotel for Winter

Fresh fruits and vegetables are the mainstay of a healthy diet. Yet without pollinators, … Read more

How to Grow a Pumpkin Patch

It’s fall, and pumpkins of all kinds are being harvested and sold. You can … Read more

Build Your Own Indoor Herb Garden

If, at the end of the growing season, you wonder where you’ll get herbs … Read more

White Carpets vs. Pet Stains: Quick and Easy Cleaning Techniques

Pets are a beloved part of the family that you might be tempted to … Read more

Create Your Own Backyard Birdhouse

Few things are more emblematic of being a good neighbor to wildlife than the … Read more

The Safest Ways to Keep Chipmunks Out of Your Yard

Chipmunks are rodents in the squirrel family and share similar qualities, like having cheek … Read more

How Did I Keep My House Pest Free

Like humans, all animals have three common desires: food, water, and shelter. If your … Read more

How to Keep Your Garage Pest Free

According to a survey conducted by Craftsman, American garages store more clutter than cars, with … Read more

How to Create a Wildlife Friendly Backyard While Protecting Your Family

When humans settle in an area, the animals that were living there originally rarely … Read more

How to Naturally Stop Mosquitoes in Your Garden

Nothing ruins a relaxing day in the backyard more than the buzzing and biting … Read more

Year Round Gardening: 4 Beautiful Seasons

In terms of year round gardening spring is the time to prepare your current … Read more

Soldier Pile Walls: The Top 4 Important Things You Need to Know

When you first hear the term ‘soldier pile walls’ various things may come to … Read more

Japanese Garden: Best Design 101

Women all over the world love a Japanese garden. So are you interested in … Read more

Backyard Design Ideas: 4 Pillars of Full Yard Salvation

When it comes to our backyard design ideas we’re all probably slightly guilty of … Read more

Sewage Backups in Basements: The Vile Truth

Sewage backups in basements can occur when sewer lines become obstructed by debris, such … Read more

Restoration Bathrooms: The Comprehensive Bathroom Remodeling Checklist

Ready for your dream restoration bathrooms? Search no more, for we have got you … Read more

The Best Rag Painting Techniques for Walls

Of all the paint treatments that can be used, rag painting techniques are one of the most subtle and elegant and is the most useful in creating a number of different decorating looks for walls. Ragging creates a broken color technique, using thinned down paint or glaze and brushing it over a base coat, then using paper towels, rags or plastic trash bags while the paint is still damp, you rag some of it off to create a mottled or textured effect on the walls.

Basement Garage: The Ultimate Guide

In this ultimate guide we will tell you all the important key points about … Read more

Are You Embarrassed By How Much It Cost To Build Your Own Shed? Here’s What To Do

The traditional shed is a unique building, that should offer unique methods of storage, … Read more

Garden Tub Decor Trends in 2023

Do you want to find the right garden tub decor to transform your bathroom … Read more

Small White Bugs in House: Whiteflies and Aphids

Those small white bugs in house are whiteflies and when viewed under a magnifying … Read more

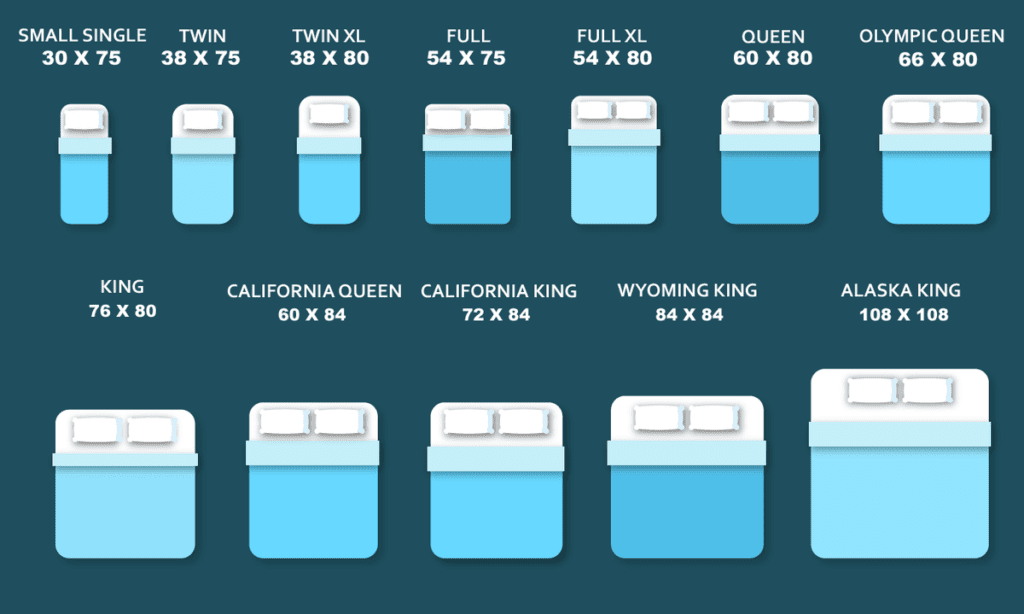

New Mattress Cost: Buying Guide

Its hard to determine your new mattress cost because there is such a wide … Read more

Attracting Bluebirds: How to Build a Bluebird Bird House

Attracting bluebirds is sometimes difficult due to other birds utilising the bird boxes first. … Read more

Fondue Plates: Host a Fondue Party

Everyone loves fondue plates and they are without a doubt the easier methods of … Read more

Renovating Room: 5 Home Improvements

Part of the fun of being a homeowner involves home improvement projects. Sometimes, these … Read more

Cute Gift Bag: Top 3 Holiday Napkin Ideas

We all need a last minute cute gift bag for someone and usually a … Read more

Lighting Consultant: 10 Great Lighting Designs

What on earth is a lighting consultant you might ask? Well a lighting consultant, … Read more

Kids Room Wall Art: Best 10 Mural Hints & Tips

Childhood. A time of magic and fun, and hopefully kids room wall art, when … Read more

Exterior and Interior Painting: Best 101

Getting ready to doo your exterior and interior painting is not a small thing. … Read more

Traditional Kitchen Ideas: 10/10 Best Vibes

Chances are that if you are here its because you’re in need of some … Read more

How to Split a Water Supply Line Like a Pro

How do you split a water supply line? Good question. Let’s go over how … Read more

The Top 9 Best Christmas and Yuletide Games

Throughout the holiday season it’s impossible to overlook all the Christmas and Yuletide games … Read more

Joseph’s Stalin’s Secret Guide To a Knot Garden

Redoing your garden? Consider doing a knot garden like Stalin’s. Knot Garden A knot … Read more

Cross Stitch Patterns Christmas Stockings

This cross stitched Christmas ornament was adapted from a bell pull pattern by Jane … Read more

Cute Packaging Ideas: 7 Christmas Ideas

Save money this holiday season by doing your own gift wrap! Exquisitely wrapped gifts … Read more

Best Sponge Wall Painting Techniques Tips You Will Read This Year

Painting walls with a sponge is one of the more creative time saving ways … Read more

How To Get A Fabulous Kitchen Renovation On A Tight Budget

Are you looking to start a kitchen remodel or a kitchen renovation and build … Read more

Recovering Furniture: How to Reupholster 101

Reupholstering is often thought of as a difficult process to go through when it … Read more

How to Make Pizza Like a Sicilian Beast

Make Your Own Pizza For many of us, the word “pizza†means a disk … Read more

Traditional Decorations: How to Tree Decorate

When I was growing up it was my job to decorate the tree with … Read more

How to Make Enchanting Traditional German Cookies

Wrapped in cellophane or a lovely gift paper, traditional German cookies are a must … Read more

Garden Shelter: Your 20 Best Options for 2023

Some form of garden shelter is something everybody should have, and if you don’t … Read more

Greenhouse With Glass: Top 10 for 2023

If you’ve got a green thumb but not a greenhouse with glass then you … Read more

Here’s How To Tighten Sink Faucet Like A Professional

If you have ever had problems with your sink faucet leaking, wobbly faucet, or … Read more

Master Warning Light: The Stone Cold Facts

So you’ve noticed your master warning light going off, and now you’re wondering, how … Read more

How To Paint High Ceilings: The Beginners Guide

If you’re wondering how to paint high ceilings, the first thing to know is … Read more

Icynene Insulation: The Number 1 Kickass Spray Foam Insulation

Looking to insulate your property? Then welcome, you’re in the right place to learn … Read more

Pallet Tree House: How to Construct (The 1 Easy Way)

Can You Build a Treehouse Out of Pallets? Every kid loves a good old … Read more

Robin Bird Houses: 12 Helpful Steps to Build

Wanna build some robin bird houses? If, like me, you love to see robins … Read more

Shower Drain Leaking? Here’s the Number 1 Way to Stop It

Is your shower drain leaking? If the answer is yes keep reading to find … Read more

Bowing Wall: 3 Urgent Reasons to Repair Now!

Bowing walls can be a serious issue and you may need to address this … Read more

Outdoor Playset For Older Kids: How to Build One Yourself

What cures summer boredom better than an outdoor playset for older kids? Sure it … Read more

Primitive Christmas Ornaments: Why Don’t You Make Your Own This Year?

In this article, you’ll learn how to make your own primitive Christmas ornaments. Here … Read more

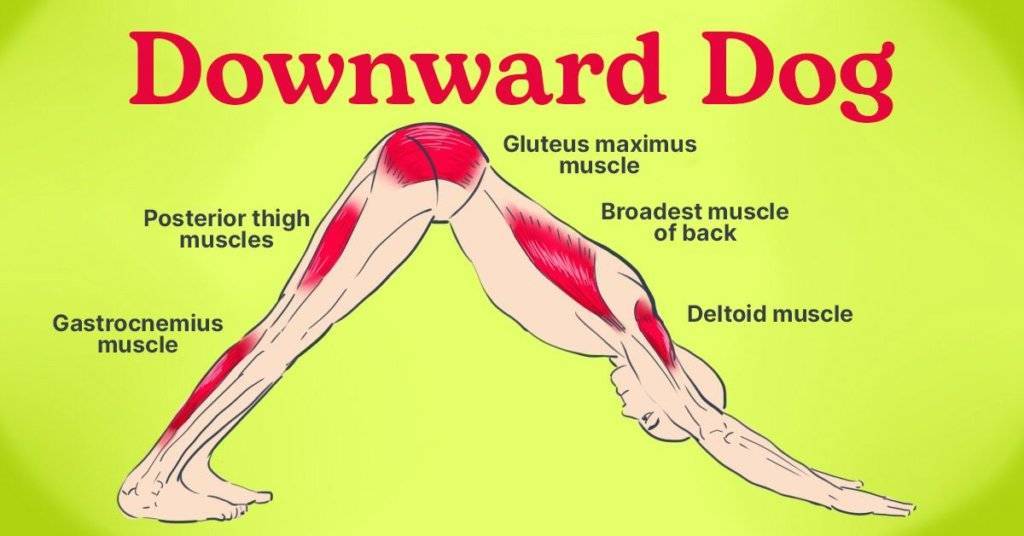

Master the Downward Doggy Yoga Pose in 2023

Getting into yoga and want to know how to do a perfect downward dog … Read more

Cane Bottom Chairs Repair: How To Do It Like A Pro

Cane Bottom Chairs Repair is a pretty straightforward process when you know what you’re … Read more

Hanging Cherry Tomato Plants: How To Grow Them at Home

Hanging cherry tomato plants are a great variety for growing upside down in hanging … Read more

How to Connect a Dryer Vent Hose In Simple, Easy Steps

In this article, you’ll learn how to connect a dryer vent hose in a … Read more

How To Make Your Jack O Lantern Scary Enough to Frighten Anyone

If you’re wanting to make your jack o lantern scary enough to make anyone … Read more

How To Make Moccasins: The Ultimate Guide

In this article, you’ll learn how to make moccasins, one step at a time … Read more

Spatter Paint Floor Technique: Make Any Floor Look Amazing

If you’ve ever seen spatter paint floor murals, they can be very attractive when … Read more

DIY Wedding Favors – Satin Rosebuds and Wedding Rice Throwers

For a smaller wedding , a more intimate party or reception which is going … Read more

Top 9 Traditional Christmas Decoration Ideas

Finding traditional Christmas decorations and keeping children occupied during the Holiday season can be … Read more

Best Garden Mini Flag Tips You Will Read This Year

There are many types of yard flags available on the market, such as a … Read more

How To Grow Basil Like a Pro

Sweet Basil Plant As we get closer to spring and have a few days … Read more